UBS Group AG Registered Ordinary Shares (UBS)

47.15

-1.01 (-2.10%)

NYSE · Last Trade: Jan 31st, 2:34 AM EST

Detailed Quote

| Previous Close | 48.16 |

|---|---|

| Open | 47.47 |

| Bid | 47.00 |

| Ask | 47.40 |

| Day's Range | 47.00 - 47.56 |

| 52 Week Range | 25.75 - 49.36 |

| Volume | 2,139,893 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 0.9040 (1.92%) |

| 1 Month Average Volume | 2,105,154 |

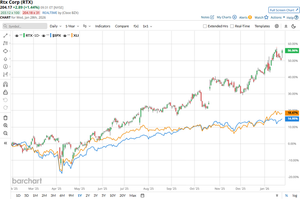

Chart

About UBS Group AG Registered Ordinary Shares (UBS)

UBS Group AG is a global financial services company providing a wide range of financial services to clients, including wealth management, investment banking, and asset management. The firm caters to private, corporate, and institutional clients, delivering tailored financial solutions and expertise across various sectors and regions. UBS is known for its strong focus on sustainable finance and innovation, striving to create long-term value for its stakeholders while maintaining a commitment to corporate responsibility and ethical practices in the financial industry. Read More

News & Press Releases

The company reported revenue of $3.02 billion for the quarter, 25% higher compared to the same period last year, and above analyst estimates of $2.9 billion.

Via Stocktwits · January 30, 2026

The American consumer is beginning to see a light at the end of the inflationary tunnel. According to the final January 2026 reading from the University of Michigan Survey of Consumers, one-year inflation expectations have eased to 4.0%, down from 4.2% in December and a peak earlier in

Via MarketMinute · January 30, 2026

Valued on earnings, SSR Mining stock looks like a buy. The cash flow picture is less clear.

Via The Motley Fool · January 30, 2026

Numa Numa Resources, 2026 Copper Demand Surge Shaping Global Markets and Mining Opportunities

Disseminated on behalf of Numa Numa Resources Inc. and may include paid advertisements.

Via Investor Brand Network · January 26, 2026

Gold is expensive. Newmont stock is cheap. Buy Newmont stock.

Via The Motley Fool · January 30, 2026

Gold is expensive. Newmont stock is cheap. Buy Newmont stock.

Via The Motley Fool · January 30, 2026

TJX Companies has delivered strong outperformance relative to the broader market over the past year, and analysts continue to express strong confidence in the stock’s long-term growth and earnings potential.

Via Barchart.com · January 30, 2026

A SpaceX and xAI merger is not good news for EchoStar, which has a stake in Elon Musk’s rocket company.

Via Stocktwits · January 29, 2026

The global financial landscape reached a historic inflection point on January 29, 2026, as gold prices surged past the $5,500 per ounce mark, marking an unprecedented milestone in the history of precious metals. This "metal mania" reflects a profound shift in investor sentiment, as the traditional pillars of the

Via MarketMinute · January 29, 2026

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla stock is sinking as the EV maker reported its first-ever annual revenue decline and boosted capex guidance. Here’s how you should play TSLA shares on its post-earnings decline.

Via Barchart.com · January 29, 2026

Shares of technology giant Microsoft (NASDAQ:MSFT) fell 11.8% in the afternoon session after the company reported mixed fourth quarter earnings: Business Services and Intelligent Cloud revenue beat, but Personal Computing missed. EPS, even after removing the impacts of OpenAI, also beat expectations.

Via StockStory · January 29, 2026

Are Wall Street analysts favoring General Motors stock post its recent earnings release?

Via Barchart.com · January 29, 2026

Barclays raised its price target to $800 from $770 and highlighted a sharp rebound in advertising momentum, noting that revenue growth above 30% has eased many lingering investor worries.

Via Stocktwits · January 29, 2026

Despite underperforming the broader market over the past year, Apollo Global Management continues to command strong confidence from Wall Street, with analysts largely optimistic about its long-term growth trajectory and earnings potential.

Via Barchart.com · January 29, 2026

The US credit market has entered 2026 with a level of momentum unseen in nearly a decade, as a powerful combination of multi-billion dollar mergers and a resurgence in leveraged buyouts (LBOs) drives primary issuance to record heights. Following the Federal Reserve’s pivot toward a more accommodative stance in

Via MarketMinute · January 28, 2026

The data storage company received a slew of price target updates from Wall Street analysts after it reported Q2 earnings that beat market expectations.

Via Stocktwits · January 28, 2026

As of January 28, 2026, RTX Corporation (NYSE: RTX) stands as a definitive titan of the global aerospace and defense industry, commanding a market capitalization that reflects its indispensable role in both commercial aviation and national security. Emerging from a transformative 2025, RTX has effectively transitioned from a period of technical remediation—primarily surrounding its Pratt [...]

Via Finterra · January 28, 2026

With a market cap of $269.9 billion, RTX Corporation ( RTX ) is a global aerospace and defense company serving commercial, military, and government customers through its three operating segments: Collins Aerospace, Pratt & Whitney, and Raytheon.

Via Barchart.com · January 28, 2026

Altria has outperformed the broader market over the past year, but analysts are cautious about the stock’s prospects.

Via Barchart.com · January 28, 2026

As of January 27, 2026, the American financial landscape is undergoing its most significant transformation since the dawn of electronic banking. The "Guiding and Establishing National Innovation for U.S. Stablecoins" (GENIUS) Act, signed into law on July 18, 2025, has successfully moved from a legislative milestone to a functioning

Via MarketMinute · January 27, 2026

Pfizer has lagged the broader market over the past year, and analysts remain cautious about its future outlook.

Via Barchart.com · January 27, 2026

Advanced Micro Devices has substantially outperformed the broader market over the past year, and analysts remain broadly optimistic about its future prospects.

Via Barchart.com · January 27, 2026

Shares of restaurant company Bloomin’ Brands (NASDAQ:BLMN)

fell 13.8% in the afternoon session after Bank of America Securities trimmed its price target on the stock to $5 from $6 and maintained its Underperform rating.

Via StockStory · January 26, 2026

Shares of casual salad chain Sweetgreen (NYSE:SG)

fell 6.3% in the morning session after an analyst at UBS lowered their rating on the stock. The bank changed its view on the company's shares, moving it from a "Buy" to a "Neutral" rating.

Via StockStory · January 26, 2026

As of January 26, 2026, the global aviation industry is navigating a paradoxical landscape of record-breaking revenues and intensified operational volatility. At the center of this narrative is United Airlines Holdings, Inc. (Nasdaq: UAL), a carrier that has spent the last five years undergoing perhaps the most ambitious transformation in its century-long history. United is [...]

Via Finterra · January 26, 2026