News

As investors look beyond U.S. stocks, JPMorgan rolls out a new active international ETF focused on developed markets.

Via Benzinga · January 30, 2026

TrueShares launches a new ETF designed to hedge market volatility while staying positioned for potential rebounds during market swings.

Via Benzinga · January 30, 2026

Software ETFs sink as Microsoft stumbles 10%, signaling a broader rethink of AI and subscription economics.

Via Benzinga · January 30, 2026

Asset management firm WisdomTree (NYSE:WT) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 33.4% year on year to $147.4 million. Its non-GAAP profit of $0.29 per share was 23.4% above analysts’ consensus estimates.

Via StockStory · January 30, 2026

Despite CSX Corporation’s underperformance relative to the broader market over the past year, Wall Street analysts maintain a strongly optimistic outlook on the stock’s prospects.

Via Barchart.com · January 30, 2026

The First Trust Managed Municipal ETF targets tax-advantaged income by investing primarily in municipal debt securities nationwide.

Via The Motley Fool · January 30, 2026

The ETF would need to continue on its current path for a couple of decades.

Via The Motley Fool · January 30, 2026

Bitcoin tapped $82,000 overnight, with liquidations at $1.80 billion over the past 24 hours. Bitcoin ETFs saw $817.9 million in net outflows on Thursday, while Ethereum ETFs reported $155.6 million in net outflows. The meme coin sector fell 9% over the past 24 hours to a total market capitalization of $40.6 billion amid the broader selloff.

Via Benzinga · January 30, 2026

While American International Group has trailed the broader market over the past 52 weeks, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

Via Barchart.com · January 30, 2026

Although Kimco Realty has lagged behind the broader market over the past year, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

Via Barchart.com · January 30, 2026

While Amcor has underperformed the broader market over the past 52 weeks, Wall Street analysts maintain a moderately optimistic outlook about the stock’s prospects.

Via Barchart.com · January 30, 2026

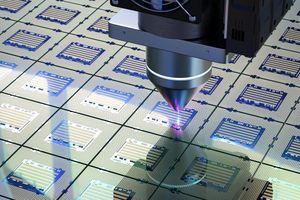

Semiconductors have been one of the market's best-performing sectors. Thanks to these catalysts, the good times may not be over yet.

Via The Motley Fool · January 30, 2026

The SPDR Gold Shares ETF has crushed Bitcoin, Nvidia, and the entire S&P 500 this year.

Via The Motley Fool · January 30, 2026

Franklin Resources has outpaced the broader market over the past year, and Wall Street analysts remain cautious about the company’s near-term performance and long-term outlook.

Via Barchart.com · January 30, 2026

Retail sentiment on major ETFs such as SPY and QQQ remains ‘bearish’ on Stocktwits despite easing shutdown risks.

Via Stocktwits · January 30, 2026

Spending on AI infrastructure is expected to be measured in the trillions of dollars.

Via The Motley Fool · January 30, 2026

This is the second time El Salvador has bought gold since 1990, following an IMF-mandated acquisition of nearly 14,000 troy ounces in 2025.

Via Stocktwits · January 30, 2026

This asset management firm targets long-term growth by investing in U.S. companies with strong management and reinvestment potential.

Via The Motley Fool · January 29, 2026

The Invesco BulletShares 2030 Corporate Bond ETF offers targeted exposure to investment grade bonds with a defined maturity profile.

Via The Motley Fool · January 29, 2026

The First Trust Enhanced Short Maturity ETF targets short-term, high-quality debt securities for income and capital preservation.

Via The Motley Fool · January 29, 2026

Investors are piling into gold on the back of surging political and economic uncertainty.

Via The Motley Fool · January 29, 2026

This fintech firm delivers mobile-first, fee-free banking services targeting U.S. consumers seeking accessible financial solutions.

Via The Motley Fool · January 29, 2026

On January 29, 2026, the global financial landscape reached a fever pitch as spot gold surged to an unprecedented all-time high of $5,595 per ounce, while silver staged a "parabolic" ascent to touch $120.45 per ounce. This monumental rally, which analysts are calling the "Great Revaluation," marks a

Via MarketMinute · January 29, 2026

The global software sector experienced one of its most turbulent trading sessions in recent history on January 29, 2026, as a wave of "sympathetic" selling swept through the industry’s heavyweights. The catalyst for the downturn was a cooling sentiment toward the artificial intelligence boom, sparked by a fiscal second-quarter

Via MarketMinute · January 29, 2026

The global financial landscape reached a historic inflection point on January 29, 2026, as gold prices surged past the $5,500 per ounce mark, marking an unprecedented milestone in the history of precious metals. This "metal mania" reflects a profound shift in investor sentiment, as the traditional pillars of the

Via MarketMinute · January 29, 2026