Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

With demand for gold and silver at a fevered pitch, speculative mania has driven premiums in China to extremely high levels, creating tension in the marketplace.

Via Talk Markets · January 29, 2026

Markets dipped before Powell, then reversed higher on a stop-hunt bounce, with earnings and shifting dollar/gold moves setting up more volatility ahead.

Via Talk Markets · January 29, 2026

Southwest Airlines shares jumped more than 12% after the company reported Q4 results and projected 2026 adjusted EPS of at least $4.00.

Via Talk Markets · January 29, 2026

Verizon has declared and paid variable quarterly dividends since January 2001. The February 2026 Quarterly dividend of $0.69 suggests a $2.76 annual dividend for the coming year.

Via Talk Markets · January 29, 2026

Although the benchmark indices opened lower, they traded volatily throughout the session and ultimately closed green.

Via Talk Markets · January 29, 2026

The technical picture on the Nasdaq 100 futures looks positive, given that it has just broken out of a multi-week consolidation to the upside this week, moving above former resistance in the 25,880 to 26,045 region.

Via Talk Markets · January 29, 2026

A 2026 post-earnings review on Tesla and its news from yesterday to pre-market open today.

Via Talk Markets · January 29, 2026

As silver prices continue to set new highs, pundits speculate about supply issues, market manipulation, and inflation fears.

Via Talk Markets · January 29, 2026

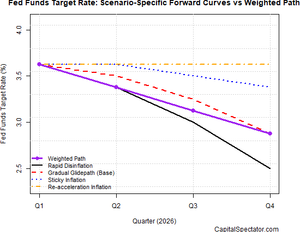

At its January 2026 meeting, the US Federal Reserve left the federal funds rate unchanged in the 3.50-3.75% range, fully meeting market expectations.

Via Talk Markets · January 29, 2026

The EUR/USD is near the 1.19500 level, with fast conditions still shaking the broad Forex market.

Via Talk Markets · January 29, 2026

As usual, the Federal Reserve did exactly what everybody expected at its January meeting.

Via Talk Markets · January 29, 2026

We don't expect any changes from the European Central Bank at next week's meeting.

Via Talk Markets · January 29, 2026

The Federal Reserve left interest rates unchanged yesterday, as expected, but the challenges are increasing for identifying the right monetary policy for the path ahead.

Via Talk Markets · January 29, 2026

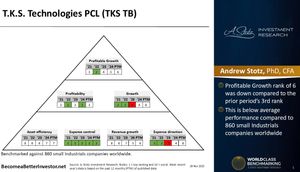

T.K.S. Technologies Public Company Limited is a holding company investing in digital technology and security solutions in Thailand.

Via Talk Markets · January 29, 2026

Comcast’s latest earnings underline how the company’s business mix is changing as pressure builds on its traditional cable operations.

Via Talk Markets · January 29, 2026

Via Talk Markets · January 29, 2026

The FTSE100 inched higher in its ascending channel as prices close in on a record peak.

Via Talk Markets · January 29, 2026

The number of Americans filing for jobless benefits for the first time declined from 210k (upwardly revised from 200k) to 209k (slightly above the 205k exp), but remained near those multi-decade lows and showed no signs of labor market stress.

Via Talk Markets · January 29, 2026

The European Commission's economic sentiment indicator increased in January, which bodes well for first-quarter growth.

Via Talk Markets · January 29, 2026

That’s what Powell keeps saying.

Via Talk Markets · January 29, 2026

GBP/USD remains near its August 2021 highs, holding around 1.3834 on Thursday, as heightened volatility in the US dollar continues to weigh on the pair.

Via Talk Markets · January 29, 2026

The market extended the greenback’s recovery when Treasury Secretary Bessent told the CNBC audience that the US always supports a strong dollar.

Via Talk Markets · January 29, 2026

In January 2026, the Fed held rates at 3.50–3.75%, signaling

Via Talk Markets · January 28, 2026

Silver's 30-day implied volatility just broke 100%. I've been in this business a long time. I cannot name another liquid commodity product that has ever hit that level.

Via Talk Markets · January 28, 2026

Stocks are due for a pullback.

Via Talk Markets · January 28, 2026

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This is a reality check for the industry.

Via Talk Markets · January 29, 2026

The Dow managed to restore strength after U.S. President Donald Trump abandoned his tariff threat against Europe, easing trade-war concerns.

Via Talk Markets · January 29, 2026

The GBP/USD forecast remains tilted to the upside, aiming for 1.3925 as the dollar loses further after the FOMC meeting.

Via Talk Markets · January 29, 2026

After cutting 14,000 jobs back in October and denying there were more of them coming, Amazon confirmed there will be another 16,000 layoffs and made comments suggesting the company won’t be done even after then.

Via Talk Markets · January 29, 2026

USD/JPY steadies post-Fed, intervention risks remain. FTSE rises as oil majors and miners rally.

Via Talk Markets · January 29, 2026

The major European stock markets had a negative day today.

Via Talk Markets · January 28, 2026

Paymentus provides a cloud-based bill payment platform.

Via Talk Markets · January 28, 2026

Caterpillar reported record Q4 revenue of $19.1 billion and adjusted earnings of $5.16 per share, beating market expectations.

Via Talk Markets · January 29, 2026

The commodities market continues to sizzle, with gold, silver, and copper hitting new highs as the weakening US dollar and rising geopolitical tensions drive investors toward tangible assets for protection.

Via Talk Markets · January 29, 2026

EUR/USD treads water near 1.2000 after bouncing up from the 1.1900 area.

Via Talk Markets · January 29, 2026

The S&P 500 has spent the bulk of January, perhaps doing so in order to work off some of the excess that the markets have seen for the last several months.

Via Talk Markets · January 29, 2026

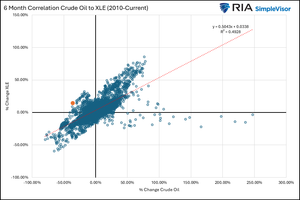

Crude oil price edged higher on Wednesday as weather disruptions and a weaker US dollar bolster the asset.

Via Talk Markets · January 29, 2026

Over the last year, energy stocks have traded well despite crude oil prices languishing.

Via Talk Markets · January 29, 2026

Global markets kick off the day with a high risk and reflation tone following the Fed’s decision to hold rates steady, which reinforced expectations for a near-term pause and helped pressure the dollar.

Via Talk Markets · January 29, 2026

Indian share markets are trading lower, with the Sensex trading 439 points lower, and the Nifty is trading 115 points lower.

Via Talk Markets · January 29, 2026

The dollar has shown signs of stabilising, but has struggled to stay bid on Bessent’s ruling out JPY intervention and a slightly hawkish Fed.

Via Talk Markets · January 29, 2026

Despite volatility from Microsoft and Meta earnings, the index is navigating a sub-minuette wave 4 correction, with gold and silver continuing their vertical, record-breaking rallies.

Via Talk Markets · January 29, 2026

AI infrastructure stocks like Arista and CoreWeave are surging. Backed by a $2.1B Nvidia investment, CoreWeave has spiked 40% this month, while Arista rides the 800G networking wave for hyperscalers like Meta.

Via Talk Markets · January 29, 2026

The Indian Rupee gains ground amid speculation of the RBI intervention, aiming to curb losses as the pair touched a fresh all-time high of 92.19 on January 28.

Via Talk Markets · January 29, 2026

can the tech titan’s results push some life back into shares? Let’s take a closer look at revisions and a few other key metrics to keep an eye on.

Via Talk Markets · January 29, 2026

META stock appears attractive as a long-term holding also because the titan issued solid guidance for its current quarter. In Q1, it sees sales coming in at $55 billion, well above the Street at $51.41 billion.

Via Talk Markets · January 29, 2026

In this video, we break down what the earnings report means for the stock technically, highlight key support and resistance levels, and outline a potential bullish trade setup that could emerge if the price holds or breaks through the right zones.

Via Talk Markets · January 29, 2026

Gold prolongs its record-setting rally for the ninth straight day and advances over 3% on Thursday, climbing to the $5,600 neighborhood during the Asian session.

Via Talk Markets · January 29, 2026

It’s a very newsworthy day on Wall Street today, with the biggest amount of consequential earnings reports — including three of the “Mag 7” — joining the latest FOMC meeting, where the Fed decided to keep rates steady as expected.

Via Talk Markets · January 28, 2026

West Texas Intermediate (WTI), the US crude oil benchmark, is trading around $63.60 during the Asian trading hours on Thursday.

Via Talk Markets · January 28, 2026

Oil markets continue to strengthen amid growing concern over a possible escalation between the US and Iran

Via Talk Markets · January 28, 2026

AUD/USD extends its gains for the third successive session, trading around 0.7040 during the Asian hours on Thursday.

Via Talk Markets · January 28, 2026

Now that some of the dust has settled, we can take a look at earnings reactions.

Via Talk Markets · January 28, 2026

We have the perfect recipe for one of my all-time favorite trades setting up on the Nasdaq and Emini. I call them Slingshot Reversals, and I'm breaking down the entire strategy in tonight's video!

Via Talk Markets · January 28, 2026

In this video, Ira Epstein covers the latest developments in the metals market, focusing on the volatility and significant price movements in gold, which has reached unprecedented levels.

Via Talk Markets · January 28, 2026

In January 2026, PM Mark Carney slashed tariffs on 49,000 Chinese EVs to 6.1% to save Canada’s canola exports from 85% duties. Trump threatened a 100% retaliatory tariff on Canada, while GM’s CEO warned of a

Via Talk Markets · January 28, 2026

We’re witnessing another stunning day in the gold and silver markets, as the gold futures are currently up over $265 on the session, while both the silver futures and spot price are back above $115.

Via Talk Markets · January 28, 2026

Stocks popped and flopped back to unchanged. VIX is wallowing, oblivious to the growing economic and geopolitical risks.

Via Talk Markets · January 28, 2026

The Fed left monetary policy unchanged in a range between 3.5% and 3.75%, but the accompanying statement and press conference suggested the Fed is more confident that the policy easing cycle is close to a conclusion.

Via Talk Markets · January 28, 2026

The personal savings rate in the US is approaching very low levels, near 3.5%. Savings levels were as high as 30% during COVID, but have decreased since then...

Via Talk Markets · January 28, 2026

Gold price surges to a fresh record high of $5,579 before retreating to around $5,500 in early Asian trading on Thursday.

Via Talk Markets · January 28, 2026

The S&P 500 finished the day flat ahead of a following uneventful Fed meeting that revealed little new beyond the view that the economy remains in reasonable shape.

Via Talk Markets · January 28, 2026

The MSCI Global Index closed up more than 21%, marking the sixth time in seven years with double-digit gains.

Via Talk Markets · January 28, 2026

The company said fourth-quarter revenue fell 3% from a year earlier to $24.9 billion, broadly in line with analyst expectations, bringing full-year sales to $94.8 billion, also down 3%.

Via Talk Markets · January 28, 2026

META's 2026 capex forecast was an absolute stunner: the company said that it anticipates 2026 capital expenditures to be in the range of $115-135 billion.

Via Talk Markets · January 28, 2026

Ethereum's price action could shift if the $2,750 support level fails.

Via Talk Markets · January 28, 2026

Micron Technology, Inc. stock has more than doubled from its low point a little over two months ago. That could be why there is unusual option activity in out-of-the-money MU puts expiring in just over 3 months.

Via Talk Markets · January 28, 2026

Humana investors may have suffered cardiac arrest yesterday after shares of the health insurer cratered 21% to close below $208 – the lowest level since early 2017.

Via Talk Markets · January 28, 2026

The US Dollar just printed fresh multi-year lows, while gold continues to ride strong bullish momentum.

Via Talk Markets · January 28, 2026

Technical analysis on the stock chart for NTRA.

Via Talk Markets · January 28, 2026

The S&P 500 touched 7,000 for the first time on Wednesday before settling just below breakeven.

Via Talk Markets · January 28, 2026

Microsoft posted adjusted earnings of $4.14 a share on revenue of $81.3 billion (better than expected earnings of $3.91 a share and revenue of $80.3 billion), beating across every segment.

Via Talk Markets · January 28, 2026

While Bitcoin legitimizes the blockchain ecosystem, Coinbase profits by operating the dollar rails that institutions actually use.

Via Talk Markets · January 28, 2026

U.S. equities tested fresh highs but struggled to build momentum as investors digested the Federal Reserve’s latest policy decision and a market rally that remained narrowly focused.

Via Talk Markets · January 28, 2026