Avocado company Mission Produce (NASDAQ:AVO) announced better-than-expected revenue in Q1 CY2025, with sales up 27.8% year on year to $380.3 million. Its non-GAAP profit of $0.12 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Mission Produce? Find out by accessing our full research report, it’s free.

Mission Produce (AVO) Q1 CY2025 Highlights:

- Revenue: $380.3 million vs analyst estimates of $296.2 million (27.8% year-on-year growth, 28.4% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.06 (significant beat)

- Adjusted EBITDA: $19.1 million vs analyst estimates of $16.6 million (5% margin, 15.1% beat)

- Operating Margin: 1.8%, down from 4.1% in the same quarter last year

- Free Cash Flow was -$25 million compared to -$4.4 million in the same quarter last year

- Sales Volumes were flat year on year (8% in the same quarter last year)

- Market Capitalization: $751.9 million

Steve Barnard, CEO of Mission, stated, "We delivered record second quarter revenue and stronger than expected adjusted EBITDA performance. Our commercial teams successfully navigated typical seasonal supply challenges by leveraging our industry-leading global source network to satisfy customer commitments. While market pricing remained elevated during the second quarter and surpassed our expectation, distributed volumes were flat with the prior year period which speaks to the durability of consumption and the growing consistency of the category at retail. We are also pleased with the progression of key strategic priorities to enhance our position with customers, both in terms of products and global markets. Our mango business gained significant market share and achieved record volumes, establishing Mission as a leading U.S. distributor, while our operations in the United Kingdom are steadily gaining momentum through enhanced customer penetration which has optimized facility utilization following the strategic investment in the region. Looking ahead to the second half of the year, we are well-positioned to generate solid cash flow as we typically do through leveraging our own increased Peruvian supply to meet strong market demand."

Company Overview

Founded in 1983 in California, Mission Produce (NASDAQ:AVO) grows, packages, and distributes avocados.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.39 billion in revenue over the past 12 months, Mission Produce is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

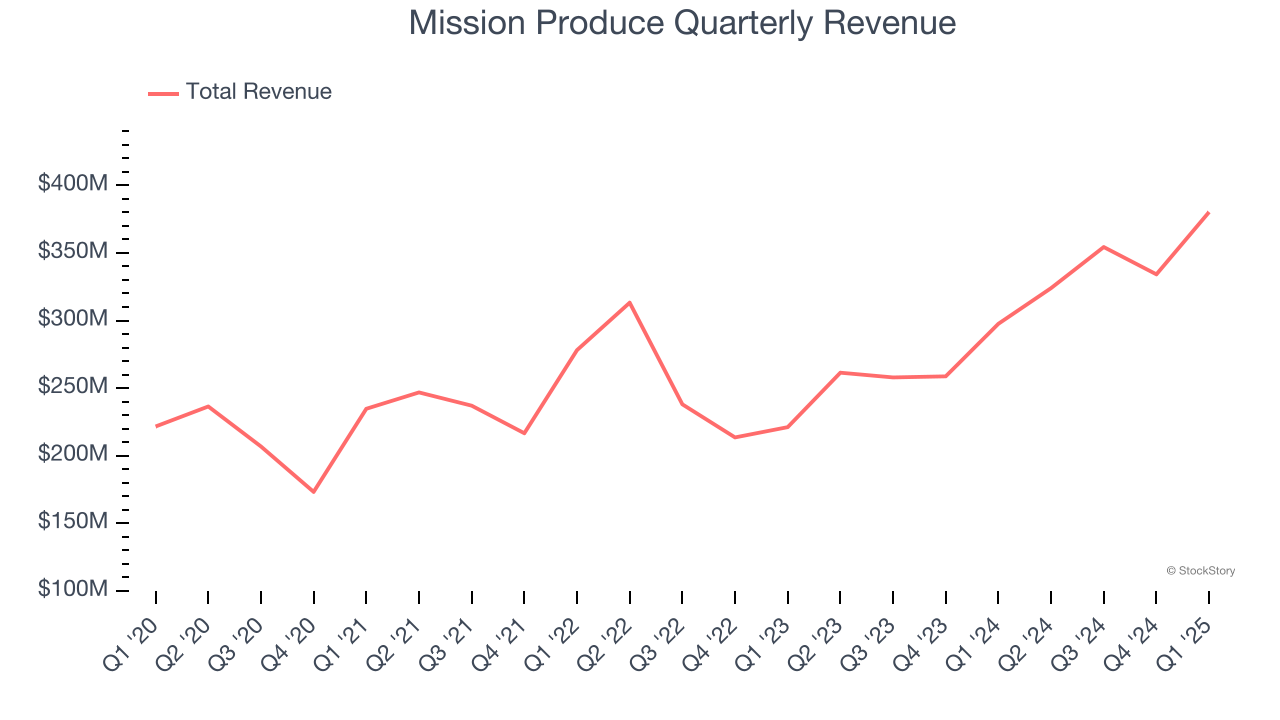

As you can see below, Mission Produce’s sales grew at a solid 12.5% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Mission Produce reported robust year-on-year revenue growth of 27.8%, and its $380.3 million of revenue topped Wall Street estimates by 28.4%.

Looking ahead, sell-side analysts expect revenue to decline by 15% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

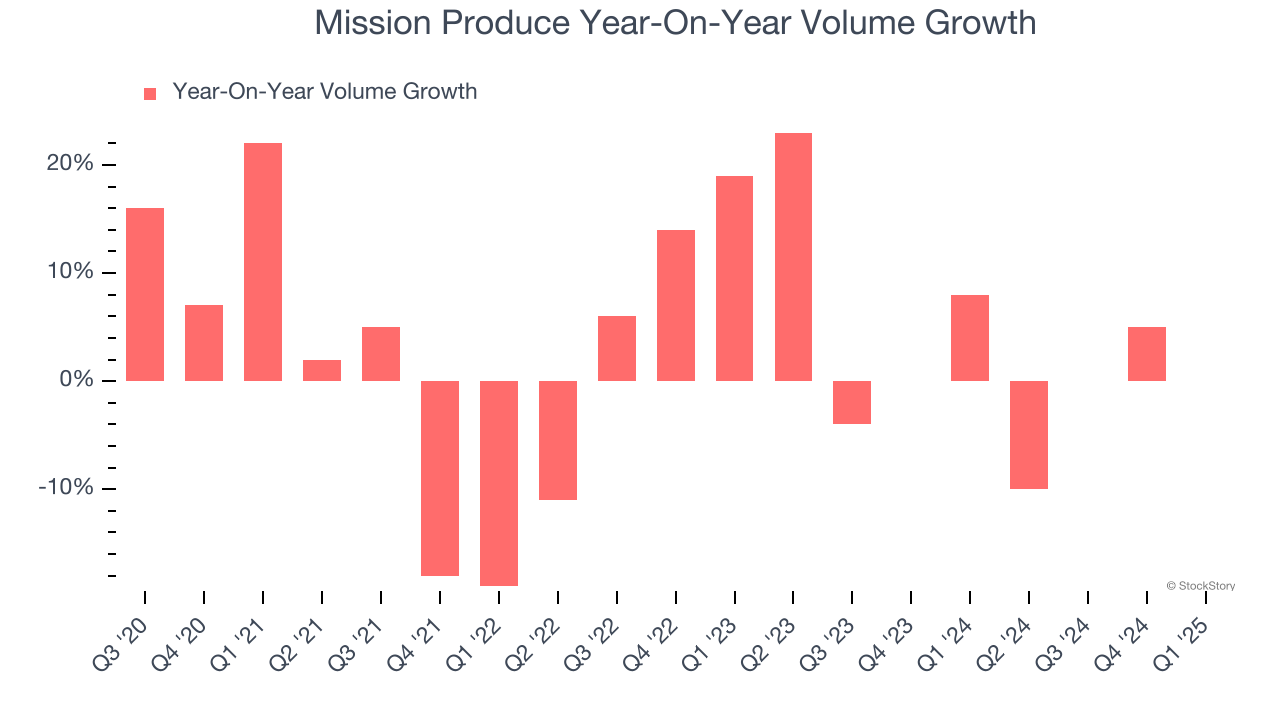

Mission Produce’s average quarterly volume growth was a healthy 2.8% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Mission Produce’s Q1 2025, year on year sales volumes were flat. This result was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Mission Produce can reaccelerate demand for its products.

Key Takeaways from Mission Produce’s Q1 Results

We were impressed by how significantly Mission Produce blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its gross margin missed. Zooming out, we think this was a solid print. The stock traded up 1.1% to $10.66 immediately after reporting.

Sure, Mission Produce had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.